A rental background check is a vital part of the tenant screening process. Its purpose is to take a deeper look at rental applicants who might seem like the right fit on paper.

Background checks allow landlords to identify red flags and avoid problematic tenants.

But what is a rental background check, really? And how can it help landlords looking for the right renters? We can help you answer those questions with the help of one of our TransUnion reports for reference.

What Is A Rental Background Check?

A rental background check is a tenant screening tool that allows landlords to see various aspects of a rental applicant’s past behavior.

The majority of the data you’ll see comes from the three major credit bureaus:

- TransUnion

- Equifax

- Experian

This data helps to paint a picture of how responsible a tenant might be by providing landlords data on applicants’ credit scores and other details.

Where Do Credit Bureaus Get Their Data?

Credit bureaus collect financial information from sources like your bank, credit card issuer, or auto finance company. They also compile publicly available information about you, such as your property or court records. It may seem redundant for there to be more than one major credit bureau, but each one looks to different sources for information, so their reports may not all be exactly the same. This helps potential landlords to feel more confident about the data they’re reviewing, since much of it has been double or triple-checked!

You can read more about credit bureaus and how they collect their data at the Federal Reserve website.

What Does A Rental Background Check Show?

Here is what one of our TransUnion rental background checks consists of:

- Personal Details – provided by the applicant (pba)

- Address (pba)

- Income (pba)

- Full Credit Score (called ResidentScore by TransUnion)

- Address History

- Employment History

- Tradelines

- Collections

- Consumer Statements

- Inquiries

- Public Records

- Eviction Records

- Criminal Records

- AKAs

Personal Details

The first step of a rental background check is for the potential tenant to provide the following required personal information:

- Full name (first and last)

- Date of birth

- Social Security Number

- Phone number

The rental applicant must provide as many of these personal details as possible – particularly their name, birthdate, and Social Security Number. With almost 330 million US residents, the more identifiers someone includes on their application, the more likely they are to get the correct information about them.

If the person applying to rent your property doesn’t have a Social Security Number or is unwilling to provide it to you, we have you covered with this blog post

Tenant’s Current Address

When going through the tenant screening process and conducting a rental background check, it’s a good idea to get an understanding of the applicant’s current living situation. Don’t assume that your potential tenant is currently renting, as they may own their current home but need to rent from you due to external circumstances.

A simple pre-screening question such as “Do you currently rent, and if so, where?” should help you better understand their current situation. It’s a good idea to keep notes throughout the tenant screening process so you can reference back to them later.

The most important thing to consider in this phase of the rental background check process is that the applicant’s current address should match the information provided on their rental application.

Tenant’s Applicant Income

The next step in running a background check in your tenant screening process is to have the applicant provide you with their income. Be sure to lay out your minimum income requirements in your tenant screening criteria so that potential tenants are well aware of your preferred rent-to-income ratio.

When having potential renters provide their own income information, you’ll want to check the following:

- Does the income listed on the rental background check match what they listed on their rental application?

- Does the income listed on the rental background check meet your minimum income standard?

Tenant Applicant’s Resident Score

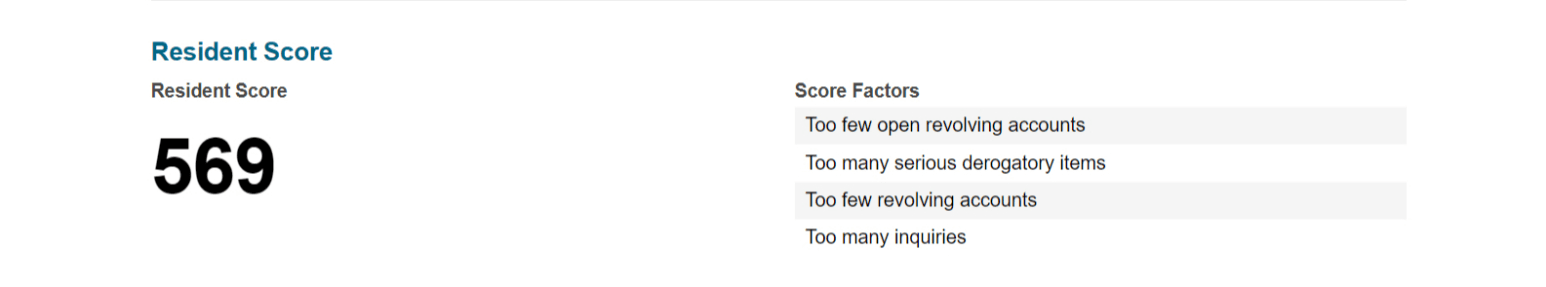

Running a rental background check through RentPrep provides you with a TransUnion Resident Score ranging from 350 – 850. This Resident Score can be compared to credit scores provided by other credit reporting agencies.

In general, you can have confidence in an applicant if their TransUnion Resident Score is equal to or above 538. The scoring ranges are as follows:

- Decline: 350 – 523

- Conditional: 524-537

- Low Accept: 538-559

- Accept: 560- 850

As was mentioned above, there is usually a discrepancy between the credit bureaus and what they report for a credit score since each bureau uses a different FICO model to assess credit.

The scale we’ve provided is specific to the TransUnion ResidentScore used with TransUnion. If your applicant runs their own credit through a different service, the numbers may differ.

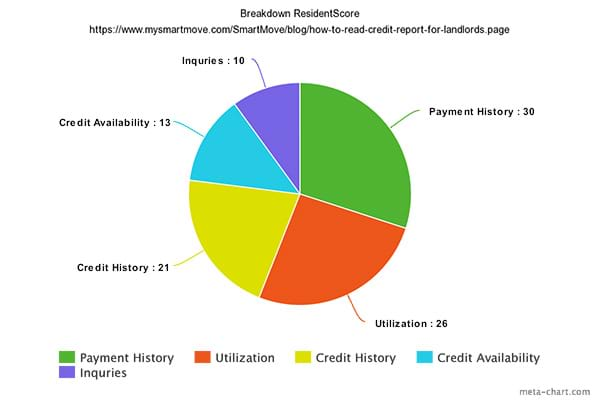

The score itself is determined by several factors, each of which is weighted differently in the calculation. TransUnion has created its own ResidentScore that has been tailored to the rental industry by giving more weight to payment history, as this information is more important to a landlord.

For instance, Credit Karma uses a VantageScore model whereas TransUnion is based on a FICO model, which is what the large majority of banks use when assessing credit for a mortgage.

Address History

It’s no secret that corporations are buying, tracking, and selling our personal information to databases. If you signed up for a magazine 10 years ago at one residence and had a cell phone plan billed to your last residence, there’s a chance that information was sold and eventually ended up in one of the databases that TransUnion pulls information from.

This is how a background check is able to pull up previous address history. Keep in mind these addresses are pulled from external sources, and therefore are not verified. It’s also important to remember that an applicant may not have been renting at one, or any, of these addresses.

Compare the address history to what was included in your rental application. Where possible, you’ll want to call and verify with the current and previous landlords that the applicant was a tenant.

Good rental history is a sign of a stable renter. If you are considering renting to someone with no rental history, be aware that you may be taking on additional risk. In these instances (usually young or student rentals) many landlords will require a co-signer and/or increased security deposit.

Employment History

Similar to address history, employment history records are cultivated from large databases. These records are not verified, so it’s important that you call the current employer to verify information.

Tradelines

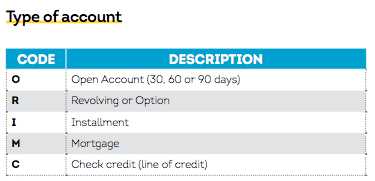

Trade Lines (or tradelines) are accounts on a background check or credit report.

This image shows the trade lines associated with our TransUnion reports.

The most common accounts for renters are revolving (credit cards) or installment accounts (anything with a fixed payment plan such as an auto loan or student loan).

Collections

Landlords should make sure to take note of any collections that show up when running a potential tenant screening. When a renter has a trade line that doesn’t get paid – such as utilities, credit cards, medical debts, or cell phone bills – the account can be sent to collections.

A one-time late payment can be considered a mistake, but a collection on your report shows a pattern of non-payment. Most services do not go immediately to collection upon payment being late, and many creditors do not send an account to collections until six months of non-payment have elapsed.

Some collections can garner wages. This can only happen if the creditor takes the consumer to court and is awarded a judgment.

If you have a renter with garnished wages, it means those funds are removed from their pay before they even see their paycheck.

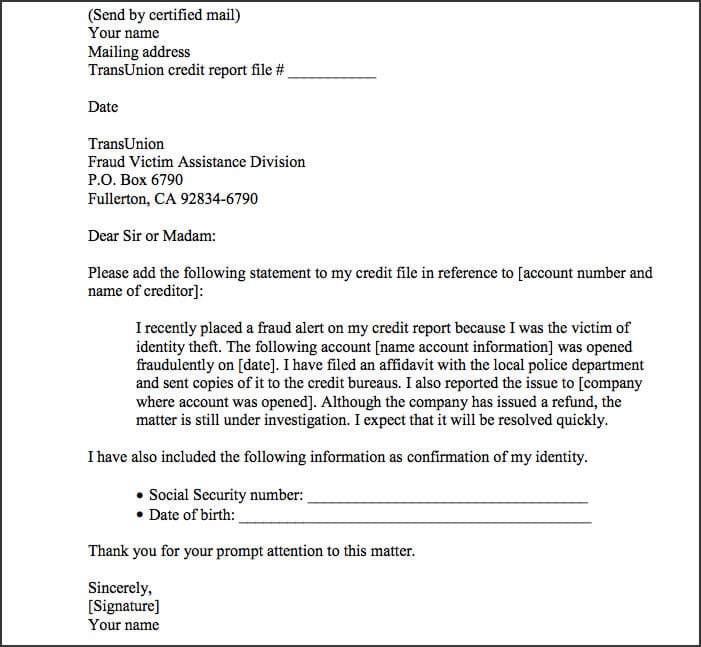

Consumer Statements

A consumer – or, in your case, a tenant applicant – has the opportunity to issue a consumer statement on their report. This is a concise statement that gives the consumer an opportunity to explain things in their report.

The above image comes courtesy of creditcards.com and is a sample of what a consumer statement looks like. In this case, the consumer was making a statement to TransUnion to explain an incident of identity theft that affected their credit score.

There are two kinds of statements (according to Experian) that a tenant can request to have added to their credit report.

- An account-specific dispute

- General statement

The account-specific dispute is linked directly to the account in question. If that account is removed from the report, the statement is removed at the same time.

The general statement lasts up to two years on a credit report and is not deleted when a specific account is removed from a report.

This could be helpful in explaining if a potential tenant’s credit was negatively impacted due to fraud, medical debt, or an error or dispute with a business.

Inquiries

In this section of the renter’s background report, you’ll see credit inquiries on your potential tenant’s record.

Credit inquiries are requests by a “legitimate business” to check your credit. If, for example, your applicant applied for an auto loan with a bank, the bank would create an inquiry to check the applicant’s credit history.

Credit inquiries are classified as either “hard inquiries” or “soft inquiries,” and only hard inquiries have an effect on a FICO score (source: MyFico).

Our TransUnion reports and credit checks are a soft pull on credit, so doing credit checks through RentPrep allows you to investigate a potential renter’s credit history without affecting their credit score.

Student and auto loan applications are each treated as one inquiry, regardless of how many applications are made, since shopping around for the best student loan or auto loan is expected. Each credit card application, however, is counted individually, as someone might be considered a higher credit risk if they’re trying to open multiple lines of credit in a short amount of time (source: MyFico

Personal Records

Public records consist of bankruptcies, civil judgments, or tax liens.

Chapter 7 bankruptcy remains on a credit report for 10 years from the filing date if there were no repayment efforts, while Chapter 13 bankruptcy is deleted from a credit report seven years from the filing date because there was full or partial repayment.

This is why some landlords will make concessions for tenants with a Chapter 13 bankruptcy, such as renting to them with an increased security deposit, but will not accept an applicant with a Chapter 7 on record.

If your potential renter has a civil judgment against them, this means they lost a civil lawsuit and they must make court-ordered payments. Civil judgments remain on credit reports for seven years.

Tax liens occur when a tenant applicant has not paid their taxes. Unpaid tax liens remain for 15 years, while paid tax liens remain for seven years from the paid date.

The public record will note whether the judgment or lien has been paid, discharged, or settled. (source – Experian).

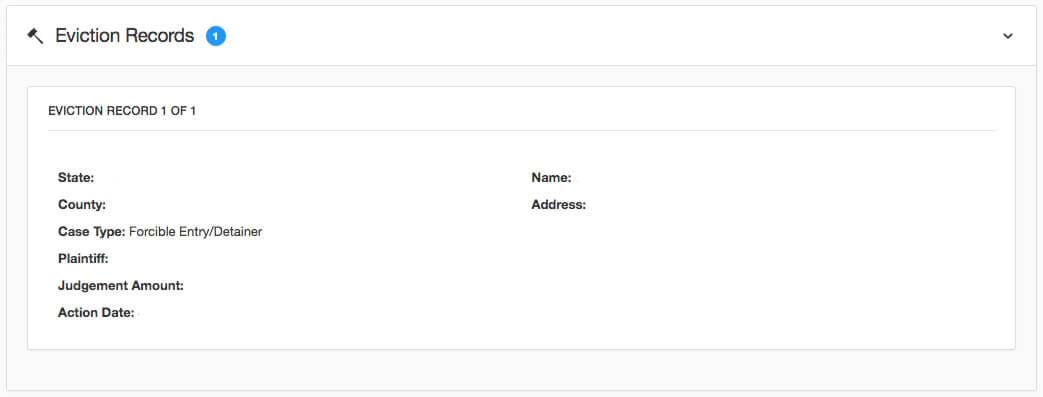

Eviction Records

Previous rental history is a good indicator of how a renter will be in the future. That is why eviction history is one of the most telling items on a background report.

Part of what you’ll receive in one of our TransUnion reports is the eviction records of your potential tenant. The image above shows a template of what is provided on an eviction record in one of our reports. Each report includes:

- The state where the eviction took place

- The county where the eviction took place

- The case type, which will read “Forcible Entry/Detainer” for an eviction

- The name of the plaintiff in the case (typically the landlord, apartment complex or property manager)

- The judgment amount of the rent owed, if any

- The action date, or the date the eviction was processed in court

- The name of the evicted person

- The address from which the person was evicted

TransUnion did a study where they analyzed records from nearly 200 properties comparing tenants who were evicted to those who were not evicted.

They found that 21.7% of the evicted tenants had a prior eviction on record, whereas only 5.5% of the non-evicted group had a previous eviction.

What does this data mean?

It means that if your tenant applicant has an eviction on record, they’re much more likely to be evicted again.

Criminal Records

How criminal records are to be considered when screening potential tenants is an ever-evolving issue. Landlords should no longer use a blanket criminal policy with rentals and it’s important to check local laws to make sure there aren’t additional considerations in your area.

However, criminal records are permissible screening tools if you can draw a connection between a criminal record and why someone wouldn’t be a good renter.

A background check will gather all available criminal data that is reportable from courts all over the country.

With our TransUnion reports, there are over 200 million records searched at the State and Federal level.

A criminal record, such as being arrested for or charged with a crime, is reportable for up to 7 years under the rules of the FCRA, while a criminal conviction is reportable indefinitely.

What Shows Up On a Criminal Record?

A criminal record will show whether your potential tenant has been arrested, charged, convicted, or sentenced in connection to a crime. The differences between these items are detailed below.

If an applicant was arrested, it means they were taken into custody but not necessarily charged with or convicted of a crime.

If your potential tenant has been charged with a crime, the prosecutor’s office decided to formally pursue legal action against them in connection with the criminal offense.

A conviction means the renter has been proven or declared guilty of the offense for which they were charged. If your potential tenant has been sentenced, a formal judgment has been issued for their punishment as a result of the conviction.

Why Does The Type Of Criminal Record Matter?

The different items that show up on a criminal record should be treated in different ways in the tenant screening process.

The Department of Housing and Urban Development (HUD) spells out that a landlord should not deny an applicant based solely on an arrest without conviction:

“A housing provider who denies housing to persons based on arrests not resulting in a conviction cannot prove that the exclusion assists in protecting the resident safety and/or property.”

This 10 page HUD document boils down to two paragraphs in the conclusion.

“Policies that exclude persons based on criminal history must be tailored to serve the housing provider’s substantial, legitimate, nondiscriminatory interest and take into consideration such factors as the type of the crime and the length of the time since conviction. Where a policy or practice excludes individuals with only certain types of convictions, a housing provider will still bear the burden of proving that any discriminatory effect caused by such policy or practice is justified. Such a determination must be made on a case-by-case basis.”

Basically, if you’re going to use a criminal record in your tenant screening process, you must make a viable case for why that crime jeopardizes the residents’ safety and/or property.

AKAs

AKA stands for “also known as” and is an alternate name or alias that a tenant might go by. For example, if your applicant’s name is “Michael Smith” an AKA might be listed as “Mike Smith.” A maiden name is the most common example of an AKA.

In the criminal sense, if the person committed a crime under a known alias (or pseudonym), that alias would show up under this section.

Some people have a known alias that acts as a nickname, while others have gone through the legal steps to change their name.

Here’s a list of famous athletes that would most likely have an AKA show up on their background check.

- Babe Ruth (George Herman Ruth, Jr.)

- Bubba Watson (Gerry Lester Watson, Jr.)

- Chad Ochocinco (Chad Javon Johnson)

- Dabo Swinney (William Christopher Swinney)

- Karim Abdul-Jabbar (Sharmon Shah)

- Spud Webb (Anthony Jerome Webb)